Being a trader, the ultimate aim is to maximize profits on ventures while decreasing deficits. Accomplishing this calls for forex traders to get a thorough comprehension of the stock markets and audio expenditure techniques. One such strategy that lots of traders forget about is learning the ability of take profit methods. In this post, we’ll take a closer look at what take profit is, the various take profit strategies, and ways to rely on them to optimize your earnings.

What exactly is Take Profit?

futures trading review is definitely an instruction that is certainly set by way of a trader that directs their dealer to close a trade every time a predetermined price levels has been reached. This is a trader’s way of sealing in revenue. Whenever a trader packages a take profit degree, they may be essentially placing the retail price degree at which they’d love to exit a industry and take their earnings. Take profit is actually a danger management strategy that is valuable in unstable marketplaces where price ranges can go up and down rapidly.

Various Take Profit Methods:

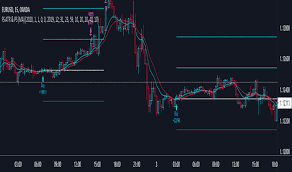

There are actually different ways of using take profit tactics, such as honest importance, specialized evaluation, and essential examination. A great way to use practical examination is to set up take profit levels at critical assist and amount of resistance ranges. This is done by studying the marketplace selling price tendency and determining crucial quantities of assistance and opposition. For instance, if a trader gets into a trade at $100 and determines a amount of resistance levels at $110, they may set up a take profit level at $109 to prevent the risk of the purchase price losing below the opposition levels.

An additional strategy is to apply a trailing quit-damage purchase as a take profit level. Trailing stop-decrease orders placed assist to lock in earnings by altering the stop loss level as price ranges relocate the trader’s favor. Because of this in the event the selling price techniques within the trader’s prefer, the end loss is altered to follow the price to ensure that when the price drops, the business is going to be shut down with the stop-reduction degree.

Utilizing Simple Analysis to put Take Earnings:

Basic evaluation is another technique that forex traders can use to set take profit degrees. This sort of evaluation necessitates the assessment of any company’s monetary and economical reputation. Forex traders can use fundamental examination to find out a company’s fair importance and set up take profit levels based upon that importance. As an example, when a trader thinks a company is undervalued, they might established a take profit stage that is more than the existing selling price.

In short:

As being a trader, mastering take profit methods is important in improving earnings. Traders should carefully evaluate the industry pattern, identify support and opposition degrees, and utilize technical and essential assessment to create take profit ranges. You need to ensure you have a very good comprehension of the marketplace and also the diverse take profit methods accessible before utilizing them. By understanding these tactics, you’ll not merely have the capacity to maximize your earnings but additionally decrease your failures.